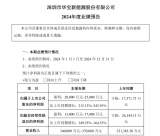

華虹半導(dǎo)體有限公司華虹半導(dǎo)體有限公司(在香港注冊(cè)成立的有限責(zé)任公司)(股票代碼:1347)截至2022年12月31日年度業(yè)績(jī)

財(cái)務(wù)亮點(diǎn)

華虹半導(dǎo)體有限公司(“公司”或“華虹半導(dǎo)體”,連同其子公司,“集團(tuán)”)董事會(huì)(“董事會(huì)”)很高興宣布公司截至2022年12月31日止年度的合并業(yè)績(jī)。

與2021數(shù)據(jù)相比,重點(diǎn)是:

收入為247550萬(wàn)美元,創(chuàng)歷史新高,比上年增長(zhǎng)51.8%。

毛利率為34.1%,與2021的27.7%相比增加了6.4個(gè)百分點(diǎn),主要原因是平均售價(jià)和產(chǎn)品組合有所改善,部分被折舊成本增加所抵消。

凈利潤(rùn)為4.066億美元,比2021增長(zhǎng)76.0%。

本年度歸屬于母公司所有者的利潤(rùn)為4.499億美元,比2021增長(zhǎng)72.1%。

基本每股收益為0.345美元,比2021增長(zhǎng)71.6%。

股本回報(bào)率為15.2%,比2021高5.5個(gè)百分點(diǎn)。

經(jīng)營(yíng)活動(dòng)產(chǎn)生的凈現(xiàn)金流量為7.509億美元,比2021增長(zhǎng)44.8%。

產(chǎn)能達(dá)到每月32.4萬(wàn)片8英寸等效晶圓,而同期為31.3萬(wàn)片。

晶圓出貨量(8英寸等效晶圓)為4087000片,而同期為3328000片。

為了更好地服務(wù)市場(chǎng)需求,提高公司在晶圓代工行業(yè)的市場(chǎng)地位和核心競(jìng)爭(zhēng)力,應(yīng)對(duì)不斷變化的市場(chǎng)環(huán)境,公司對(duì)股東保持穩(wěn)定、謹(jǐn)慎和負(fù)責(zé)任的政策。根據(jù)可持續(xù)經(jīng)營(yíng)和長(zhǎng)期發(fā)展的原則,董事會(huì)不建議支付截至2022年12月31日的年度股息(2021:無(wú))。公司將保留足夠的現(xiàn)金來(lái)繼續(xù)其投資活動(dòng),以使股東利益最大化。

致股東的信函

尊敬的股東們:,

2022年是非同尋常、充滿挑戰(zhàn)的一年,幾乎所有世界經(jīng)濟(jì)體都受到了百年一遇疫情持續(xù)死灰復(fù)燃、全球產(chǎn)業(yè)供應(yīng)鏈重塑和地緣政治挑戰(zhàn)的影響。半導(dǎo)體行業(yè)也進(jìn)入了調(diào)整期。盡管宏觀環(huán)境存在諸多不確定性,但華虹半導(dǎo)體在2022年繼續(xù)開(kāi)拓進(jìn)取,并取得了持續(xù)改善,其增長(zhǎng)在行業(yè)中處于領(lǐng)先地位。憑借“8英寸+12英寸”戰(zhàn)略的優(yōu)勢(shì),公司致力于專業(yè)工藝技術(shù)的持續(xù)創(chuàng)新,并利用我們的專業(yè)工藝平臺(tái),包括嵌入式/獨(dú)立非易失性存儲(chǔ)器、電源設(shè)備和模擬與PM,發(fā)展了產(chǎn)品的核心競(jìng)爭(zhēng)力。我們堅(jiān)持先進(jìn)的“專業(yè)集成電路+功率分立”雙管齊下戰(zhàn)略,迅速滲透下游新興市場(chǎng),拓展汽車(chē)、新能源、物聯(lián)網(wǎng)、數(shù)據(jù)中心等市場(chǎng),不斷為全球客戶提供卓越的晶圓代工服務(wù)和解決方案。

報(bào)告期內(nèi),公司收入創(chuàng)下247550萬(wàn)美元的歷史新高,比上年增長(zhǎng)51.8%,來(lái)自美國(guó)、歐洲、日本和中國(guó)的地區(qū)收入大幅增長(zhǎng)。2022年,我們的細(xì)分市場(chǎng)需求強(qiáng)勁。公司汽車(chē)電子產(chǎn)品年收入同比增長(zhǎng)超過(guò)100%,新產(chǎn)品引進(jìn)數(shù)量持續(xù)增加。同時(shí),公司在新能源市場(chǎng)穩(wěn)步發(fā)展,在支持全球風(fēng)電/光電/儲(chǔ)能領(lǐng)域的產(chǎn)業(yè)鏈方面發(fā)揮了重要作用。多元化的工藝平臺(tái)、豐富的國(guó)內(nèi)外客戶資源以及前瞻性和專注性的產(chǎn)能安排,使華虹半導(dǎo)體在行業(yè)周期下行的情況下仍保持了行業(yè)領(lǐng)先的產(chǎn)能利用率。年內(nèi),公司整體毛利率達(dá)到34.1%,比上年提高6.4個(gè)百分點(diǎn)。本年度利潤(rùn)為4.066億美元,較上年增長(zhǎng)76.0%;凈資產(chǎn)收益率為15.2%,比上年增長(zhǎng)5.5個(gè)百分點(diǎn)。

截至2022年底,華虹半導(dǎo)體擁有三家8英寸晶圓廠和一家12英寸晶圓廠。最近三年,年產(chǎn)能(8英寸晶圓當(dāng)量)每年從248.52萬(wàn)片增加到326.04萬(wàn)片,然后是386.27萬(wàn)片,復(fù)合年增長(zhǎng)率為24.67%。現(xiàn)有的12英寸晶圓廠在2022年實(shí)現(xiàn)了高水平運(yùn)營(yíng),月產(chǎn)能為6.5萬(wàn)片。該公司計(jì)劃在2023年將月產(chǎn)能提高到9.5萬(wàn)片,并將在適當(dāng)時(shí)候開(kāi)始建設(shè)一條新的12英寸生產(chǎn)線,繼續(xù)提高其制造能力。

下文是華虹半導(dǎo)體2022年度業(yè)績(jī)報(bào)告原文:

Hua Hong Semiconductor Annual Results 2022

HUA HONG SEMICONDUCTOR LIMITED華虹半導(dǎo)體有限公司(Incorporated in Hong Kong with limited liability)(Stock code: 1347)ANNUAL RESULTS ANNOUNCEMENTFOR THE YEAR ENDED 31 DECEMBER 2022

FINANCIAL HIGHLIGHTS

The Board of Directors (“the Board”) of Hua Hong Semiconductor Limited (“the Company” or “Hua Hong Semiconductor”, together with its subsidiaries, the “Group”) is pleased to announce the consolidated results of the Company for the year ended 31 December 2022.

Highlights in comparison with 2021 figures are:

Revenue was US$2,475.5 million, an all-time high and an increase of 51.8% over the prior year.

Gross margin was 34.1%, increased by 6.4 percentage points,compared to 27.7% in 2021,mainly due to improved average selling price and product mix, partially offset by increased depreciation costs.

Net profit was $406.6 million, 76.0% over 2021.

Profit for the year attributable to owners of the parent was US$449.9 million, 72.1% over 2021.

Basic earnings per share was US$0.345, 71.6% over 2021.

Return on equity was 15.2%, 5.5 percentage points over 2021.

Net cash flows generated from operating activities was US$750.9 million, 44.8% over 2021.

Capacity reached 324,000 8-inch equivalent wafers per month, compared to 313,000.

Wafer shipments (in 8-inch equivalent wafers) was 4,087,000, compared to 3,328,000.

In order to better serve market demand, enhance the Company’s market position and core competitiveness in the wafer foundry industry, and cope with the changing market environment, the Company is maintaining a stable, prudent, and responsible policy for our shareholders. Based on the principles for a sustainable operation and long-term development, the Board did not recommend the payment of any dividend for the year ended 31 December 2022 (2021: nil). The Company will retain sufficient cash to continue its investment activities, in order to maximize benefits for our shareholders.

LETTER TO SHAREHOLDERS

Dear Shareholders,

In 2022, an extraordinary and challenging year, almost all the world’s economies were affected by the continuous resurgence of the once-in-a-century pandemic, reshaping of the global industry supply chain, and geopolitical challenges. The semiconductor industry also entered a period of adjustment. Despite many uncertainties in the macro environment, Hua Hong Semiconductor continued to forge ahead and made continuous improvement in 2022, with its growth leading the industry. With the advantages of our “8-inch + 12-inch” strategy, the Company stayed committed to continuous innovation of specialized process technologies and developed core competitiveness of products using our specialized process platforms, including embedded/standalone non-volatile memory, power device, and analog & PM. We persisted in our advanced “Specialty IC + Power Discrete” dual-pronged strategy, rapidly penetrated downstream emerging markets, expanded our markets in automobiles, new energy, Internet of Things, data centers, etc., continuously providing excellent wafer foundry services andsolutions for our global customers.

During the reporting period, the Company’s revenue hit a record high of US$2,475.5 million, representing an increase of 51.8% compared to the previous year, and regional revenues from the United States, Europe, Japan, and China increased significantly. In 2022, we experienced strong demand in our market segments. The Company achieved a year-on-year increase of more than 100% in annual revenue from automotive electronics and a continual increase in the number of new products introduced. Meanwhile, the Company made steady progress in the new energy market and played a significant role in supporting the global industry chain in the wind power/photoelectricity/energy storage field. Diversified process platforms, abundant customer resources at home and abroad, and a forward-looking and dedicated capacity arrangement enabled Hua Hong Semiconductor to maintain leading capacity utilization rate in the industry, despite the downward cycle of the industry. In the year, the overall gross profit margin of the Company reached 34.1%, representing an increase of 6.4 percentage points compared to the previous year. Profit for the year was US$406.6 million, representing an increase of 76.0% compared to the previous year; ROE was 15.2%, representing an increase of 5.5 percentage points compared to the previous year.

As at the end of 2022, Hua Hong Semiconductor had three 8-inch fabs and one 12-inch fab. For the most recent three years, annual production capacity (8-inch wafer equivalent) increased each year from 2.4852 million to 3.2604 million and then 3.8627 million, with a CAGR of 24.67%. The existing 12-inch fab was operated at a high level with a monthly production capacity of 65,000 wafers in 2022. The Company plans to increase its monthly production capacity to 95,000 wafers in 2023 and will start construction of a new 12-inch production line in due course, continuing to improve its manufacturing capacity and technological upgrading.

As a key part of the global semiconductor industry supply chain, the Company has markets covering the whole industry, with its strong industry presence. With robust strength in semiconductor manufacturing in China, the Company won the “20-year Special Contribution Award in China Semiconductor in 2022 China IC Design Achievement Award.” As a well-known enterprise in Shanghai, the Company worked judiciously in cities to promote regional economic development in the Yangtze River Delta. Its contribution was recognized by all corners of society. In the year, it won the “Outstanding Contribution Award for Scientific and Technological Innovation in Pudong New Area” again.

Only with diligent employees will we be able to achieve success in the face of more complicated and fierce competition. We will continue to strengthen our advantages in various specialized technologies, constantlyoptimize product structure in close alignment with market trends, and accumulate new momentum for high-quality development. New opportunities will be identified from challenges and new prospects will be opened up in a changing environment. Hua Hong Semiconductor will unswervingly innovate with international vision to create new products for our customers all over the world and make achievements by establishing development projects in new areas of technology. We sincerely thank all our employees, shareholders, customers, and friends from all walks of life for their support for and cooperation with Hua Hong Semiconductor. Let’s work together to achieve another year of splendid results.

Mr. Suxin Zhang

Chairman and Executive Director

Mr. Junjun Tang

President and Executive Director

Shanghai, PRC

30 March 2023

About the Company

Hua Hong Semiconductor Limited (“Hua Hong Semiconductor”, stock code: 1347.HK) (the “Company”) is a global, leading pure-play foundry focused on continuous innovation of “8-inch + 12-inch” specialty technologies, including non-volatile memory (“NVM”), power discrete, analog & power management, and logic & RF, supporting applications in emerging areas, such as the Internet of Things, using advanced “Specialty IC + Power Discrete” technology platforms. Of special note is the Company’s outstanding quality control system that satisfies the strict requirements of automotive chip manufacturing. The Company is part of the Huahong Group, an enterprise group whose main business is IC manufacturing, with advanced “8-inch + 12-inch” production line technology.

The Company presently operates three 8-inch wafer fabrication facilities (HH Fab1, HH Fab2, and HH Fab3) in Jinqiao and Zhangjiang, Shanghai, with a total monthly 8-inch wafer capacity of approximately 180,000 wafers. The 12-inch wafer fabrication facility (HH Fab7) in Wuxi National High-Tech Industrial Development Zone, at a 65,000 wafer per month capacity, has become a leading 12-inch foundry devoted to power discrete semiconductors in the Chinese mainland.

-

集成電路

+關(guān)注

關(guān)注

5420文章

11949瀏覽量

367139 -

晶圓

+關(guān)注

關(guān)注

52文章

5118瀏覽量

129162 -

華虹半導(dǎo)體

+關(guān)注

關(guān)注

3文章

98瀏覽量

38033 -

華虹宏力

+關(guān)注

關(guān)注

0文章

16瀏覽量

4954

原文標(biāo)題:Hua Hong Semiconductor Annual Results 2022

文章出處:【微信號(hào):華虹宏力,微信公眾號(hào):華虹宏力】歡迎添加關(guān)注!文章轉(zhuǎn)載請(qǐng)注明出處。

發(fā)布評(píng)論請(qǐng)先 登錄

砥礪創(chuàng)新 芯耀未來(lái)——武漢芯源半導(dǎo)體榮膺21ic電子網(wǎng)2024年度“創(chuàng)新驅(qū)動(dòng)獎(jiǎng)”

高通Q1業(yè)績(jī)創(chuàng)歷史新高,手機(jī)與汽車(chē)芯片表現(xiàn)搶眼

華寶新能2024年營(yíng)收創(chuàng)歷史新高 同比增長(zhǎng)146.94%至159.91%

2024年全球AMOLED智能手機(jī)面板出貨量創(chuàng)歷史新高

全志科技2024年度業(yè)績(jī)預(yù)告:凈利潤(rùn)大幅增長(zhǎng)

京東方發(fā)布2024年度業(yè)績(jī)預(yù)告

日本半導(dǎo)體制造設(shè)備銷(xiāo)售額預(yù)期上調(diào),創(chuàng)歷史新高!

半導(dǎo)體企業(yè)2024年業(yè)績(jī)預(yù)告

韓國(guó)半導(dǎo)體出口強(qiáng)勁增長(zhǎng),2024年創(chuàng)歷史新高!

華虹半導(dǎo)體2022年度業(yè)績(jī)創(chuàng)歷史新高 比上年增長(zhǎng)51.8%

華虹半導(dǎo)體2022年度業(yè)績(jī)創(chuàng)歷史新高 比上年增長(zhǎng)51.8%

評(píng)論