2022年5月5日—安森美(onsemi,美國納斯達克股票代號:ON)公布其2022年第1季度業績,亮點如下:

·破紀錄收入19.45億美元,同比增長31%

·公認會計原則(GAAP)攤薄后每股收益為1.18美元,去年同期為0.20美元

·破紀錄非GAAP攤薄后每股收益1.22美元,去年同期為0.35美元

·破紀錄GAAP和非GAAP毛利率49.4%,同比增長1,420基點

·破紀錄GAAP運營利潤率33.3%,環比增長730基點,同比增長2,480基點

·破紀錄非GAAP運營利潤率33.9%,環比增長530基點,同比增長2,060基點

·過去12個月(LTM)自由現金流利潤率為20.8%

安森美總裁兼首席執行官(CEO) Hassane El-Khoury說:“我們的重點戰略為onsemi 的利潤率和增長帶來了持續的成果,汽車和工業終端市場現在占我們收入的65%。我們的第1季度業績創歷史新高,收入同比增長31%,毛利率增長1,420 個基點至破紀錄的49.4%,突顯了我們持續脫胎換骨的業務實力和產品價值。憑借高度差異化的智能電源和智能感知產品組合、長期供應協議帶來的強大能見度,以及應對汽車功能電子化、先進駕駛輔助系統(ADAS)、能源基礎設施和工廠自動化等現世大趨勢,我們在保持我們的發展勢頭上處于有利地位。”

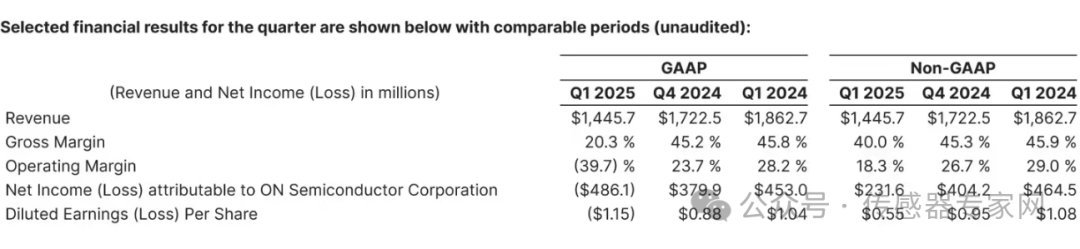

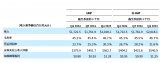

下表概列2022年第1季度與可比較時期的部分財務業績:

| GAAP | Non-GAAP | ||||||

| (以百萬美元計,每股數據除外) | Q1 2022 | Q4 2021 | Q1 2021 | Q1 2022 | Q4 2021 | Q1 2021 | |

| 收入 | $1,945.0 | $1,846.1 | $1,481.7 | $1,945.0 | $1,846.1 | $1,481.7 | |

| 毛利率 | 49.4% | 45.1% | 35.2% | 49.4% | 45.2% | 35.2% | |

| 營運利潤率 | 33.3% | 26.0% | 8.5% | 33.9% | 28.6% | 13.3% | |

| 安森美應占收入凈額 | $530.2 | $425.9 | $89.9 | $538.5 | $478.0 | $151.3 | |

| 每股攤薄盈利 | $1.18 | $0.96 | $0.20 | $1.22 | $1.09 | $0.35 |

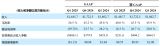

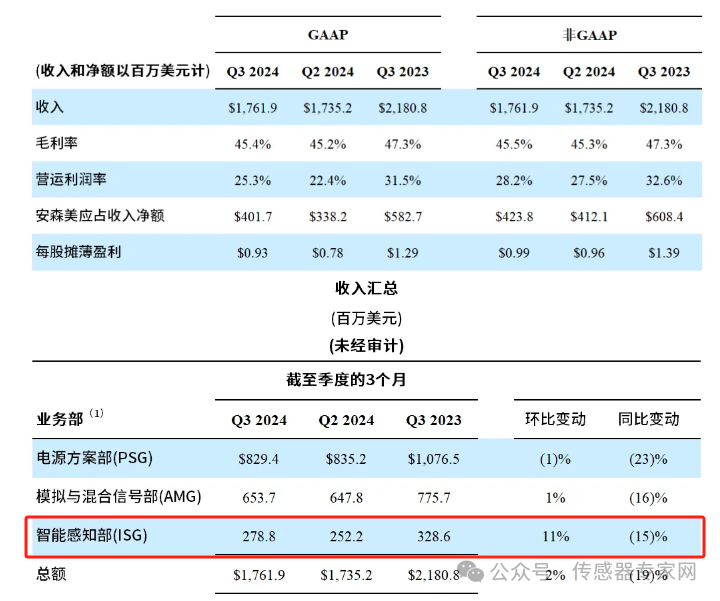

| 收入匯總 | ||||||

| (百萬美元) | ||||||

| (未經審計) | ||||||

| 截至季度的3個月 | ||||||

| 產品部 | Q1 2022 | Q4 2021 | Q1 2021 | 環比變動 | 同比變動 | |

| 電源方案部(PSG) | $986.7 | $953.4 | $747.0 | 3% | 32% | |

| 先進方案部(ASG) | $ 689.3 | $647.3 | $531.5 | 6% | 30% | |

| 智能感知部(ISG) | $ 269.0 | $245.4 | $203.2 | 10% | 32% | |

| 總額 | $ 1,945.0 | $1,846.1 | $1,481.7 | 5% | 31% |

2022年第2季度展望

下表概列安森美預計2022年第2季度的GAAP及non-GAAP展望:

| 安森美GAAP總額 | 特別項目** | 安森美non-GAAP總額*** | |

| 收入 | $1,965百萬美元至$2,065百萬美元 | - |

$1,965百萬美元至 $2,065百萬美元 |

| 毛利率 | 48.5%至50.5% | - | 48.5%至50.5% |

| 營運支出 |

$330百萬美元至 $345百萬美元 |

$25百萬美元 |

$305百萬美元至 $320百萬美元 |

| 其它收入及支出凈額(包括利息支出) |

$20百萬美元至 $24百萬美元 |

- |

$20百萬美元至 $24百萬美元 |

| 每股攤薄盈利 | $1.13美元至$1.25美元 | $0.07美元 | $1.20美元至$1.32美元 |

| 攤薄股數* | 450百萬 | 7百萬 | 443百萬 |

FINANCIALS

* Diluted shares outstanding can vary as a result of, among other things, the actual exercise of options or vesting of restricted stock units, the incremental dilutive shares from the Company's convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods when the quarterly average stock price per share exceeds $20.72 for the 1.625% Notes and $52.97 for the 0% Notes, the non-GAAP diluted share count and non-GAAP net income per share include the anti-dilutive impact of the Company’s hedge transactions issued concurrently with the 1.625% Notes and the 0% Notes, respectively. At an average stock price per share between $20.72 and $30.70 for the 1.625% Notes and $52.97 and $74.34 for the 0% Notes, the hedging activity offsets the potentially dilutive effect of the 1.625% Notes and 0% Notes, respectively. In periods when the quarterly average stock price exceeds $30.70 for the 1.625% Notes, and $74.34 for the 0% Notes, the dilutive impact of the warrants issued concurrently with such notes are included in the diluted shares outstanding. GAAP and non-GAAP diluted share counts are based on either the previous quarter's average stock price or the stock price as of the last day of the previous quarter, whichever is higher.

Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; non-recurring facility costs, purchased in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; non-cash interest expense; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact or probable significance of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward-looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

*** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures, even if they have similar names.

電話會議

安森美已于美國東部時間(ET)2022年5月2日上午9時為金融界舉行電話會議,討論此次的發布及安森美2022年第1季度的業績。英語電話會議將在公司網站http://www.onsemi.cn的“投資者關系”網頁作實時廣播。實時網上廣播大約1小時后在該網站回放,為時30天。

This document includes “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated in this document could be deemed forward-looking statements, particularly statements about the future financial performance of onsemi, including financial guidance for the year ending December 31, 2022. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans” or “anticipates” or by discussions of strategy, plans or intentions. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. Certain factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in the 2021 Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 14, 2022 (the “2021 Form 10-K”) and from time to time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks and uncertainties described in this document, our 2021 Form 10-K and subsequent reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

-

安森美

+關注

關注

32文章

1771瀏覽量

92823 -

工業4.0

+關注

關注

48文章

2043瀏覽量

120123 -

汽車

+關注

關注

14文章

3800瀏覽量

39228

發布評論請先 登錄

花旗:小米Q1毛利率表現突出 毛利率提升0.5個百分點至22.8%

AMD一季度營收74.4億美元超預期 AMD公布2025年第一季度財報

安森美2024年Q4及全年業績亮眼

意法半導體2024年第四季度總結回顧

AMD公布2024年第三季度財報

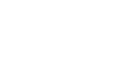

安森美公布 2024 年第三季度業績

毛利率下滑,芯片企業如何逆風翻盤?

安森美公布破紀錄2022年第1季度 收入、毛利率和non-GAAP每股收益

安森美公布破紀錄2022年第1季度 收入、毛利率和non-GAAP每股收益

評論