2022年2月8日—安森美(onsemi,美國(guó)納斯達(dá)克股票代號(hào):ON)于美國(guó)時(shí)間2月7日公布了其第4季度及2021財(cái)年的業(yè)績(jī),亮點(diǎn)如下:

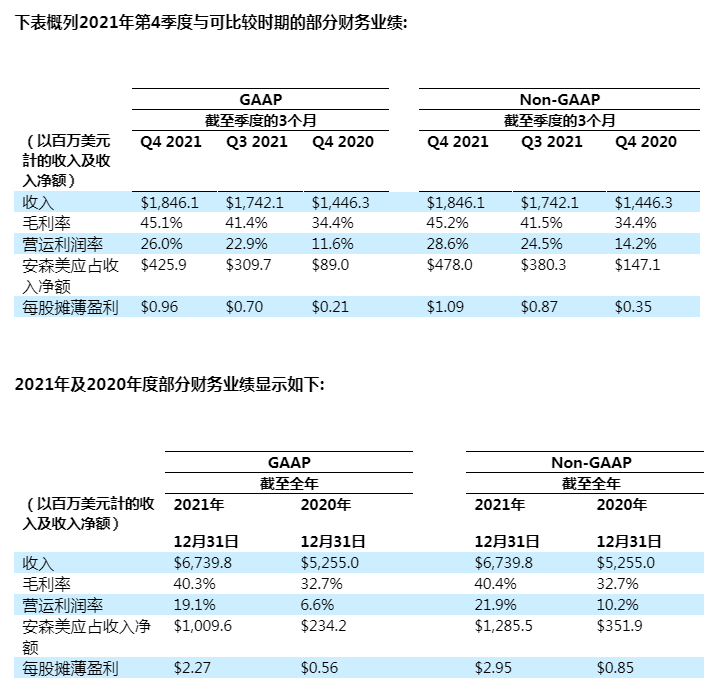

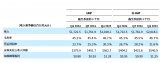

·創(chuàng)紀(jì)錄的財(cái)年收入67.4億美元,同比增長(zhǎng)28.3%

·創(chuàng)紀(jì)錄的季度收入18.461億美元,創(chuàng)紀(jì)錄的公認(rèn)會(huì)計(jì)原則(GAAP)和非GAAP毛利率分別為45.1%和45.2%

·創(chuàng)紀(jì)錄的季度GAAP和非GAAP運(yùn)營(yíng)利潤(rùn)率分別為26.0%和28.6%

·第四季度GAAP和非GAAP攤薄后每股收益分別為0.96美元和1.09美元; 2021年自由現(xiàn)金流同比增長(zhǎng)167%,第四季度為4.57億美元或收入的25%

安森美總裁兼首席執(zhí)行官(CEO) Hassane El-Khoury說:“我們?cè)?021年紀(jì)律嚴(yán)明地執(zhí)行轉(zhuǎn)型舉措,導(dǎo)致了創(chuàng)紀(jì)錄的財(cái)務(wù)業(yè)績(jī),并提前實(shí)現(xiàn)了我們的財(cái)務(wù)目標(biāo)。2021年的收入增長(zhǎng)了28.3%。營(yíng)業(yè)收入和自由現(xiàn)金流的增長(zhǎng)速度是收入的6倍,因?yàn)槲覀儼旬a(chǎn)品組合集中在電動(dòng)汽車、先進(jìn)駕駛輔助系統(tǒng)(ADAS)、替代能源和工業(yè)自動(dòng)化等世俗大趨勢(shì)上。隨著我們將產(chǎn)品組合轉(zhuǎn)向這些高價(jià)值的戰(zhàn)略市場(chǎng),我們將繼續(xù)擴(kuò)大毛利率,同時(shí)增加新產(chǎn)品,合理化我們的制造足跡,并改善我們的整體成本結(jié)構(gòu)。我們的業(yè)務(wù)前景依然強(qiáng)勁,在我們高度差異化的智能電源和感知產(chǎn)品組合的帶動(dòng)下,我們的設(shè)計(jì)勝選漏斗同比增長(zhǎng)超過60%。就是明證。”

下表概列2021年第4季度與可比較時(shí)期的部分財(cái)務(wù)業(yè)績(jī):

* Convertible Notes, Non-cash Interest Expense is calculated pursuant to FASB’s Accounting Standards Codification Topic 470: Debt.

* Diluted shares outstanding can vary as a result of, among other things, the vesting of restricted stock units, the incremental dilutive shares from the Company‘s convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. With the adoption of the new accounting standard, the GAAP diluted shares outstanding assumes settling the principal and excess over par value in shares of the Company’s common stock for the 1.625% Notes and only the excess over par value in shares of the Company’s common stock for the 0% Notes, according to the terms of such notes. The non-GAAP diluted shares outstanding includes the shares that are not covered by the Company’s hedge transaction issued concurrently with such notes. In periods when the quarterly average stock price exceeds $30.70 for the 1.625% Notes and $74.34 for the 0% Notes, the dilutive impact of the warrants issued concurrently with such notes are included in the GAAP and non-GAAP diluted shares outstanding. Calculations are based on the Company’s stock price as of December 31, 2021.

** Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; purchased in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; non-cash interest expense; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact or probable significance of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward-looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

*** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures, even if they have similar names.

電話會(huì)議

安森美已于美國(guó)時(shí)間2022年2月7日美國(guó)東部時(shí)間 (EST)上午9時(shí)為金融界舉行電話會(huì)議,討論安森美2021年第4季度及全年的業(yè)績(jī)。英語電話會(huì)議將在公司網(wǎng)站http://www.onsemi.cn的“投資者關(guān)系”網(wǎng)頁作實(shí)時(shí)廣播。實(shí)時(shí)網(wǎng)上廣播大約1小時(shí)后在該網(wǎng)站回放,為時(shí)30天。

This document includes “forward-looking statements,” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated in this document could be deemed forward-looking statements, particularly statements about the future financial performance of onsemi, including financial guidance for the year ending December 31, 2021. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans” or “anticipates” or by discussions of strategy, plans or intentions. All forward-looking statements in this document are made based on our current expectations, forecasts, estimates and assumptions and involve risks, uncertainties and other factors that could cause results or events to differ materially from those expressed in the forward-looking statements. Certain factors that could affect our future results or events are described under Part I, Item 1A “Risk Factors” in the 2020 Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 16, 2021 (the “2020 Form 10-K”) and from time to time in our other SEC reports. Readers are cautioned not to place undue reliance on forward-looking statements. We assume no obligation to update such information, except as may be required by law. You should carefully consider the trends, risks and uncertainties described in this document, our 2020 Form 10-K and subsequent reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

-

安森美

+關(guān)注

關(guān)注

32文章

1767瀏覽量

92765

發(fā)布評(píng)論請(qǐng)先 登錄

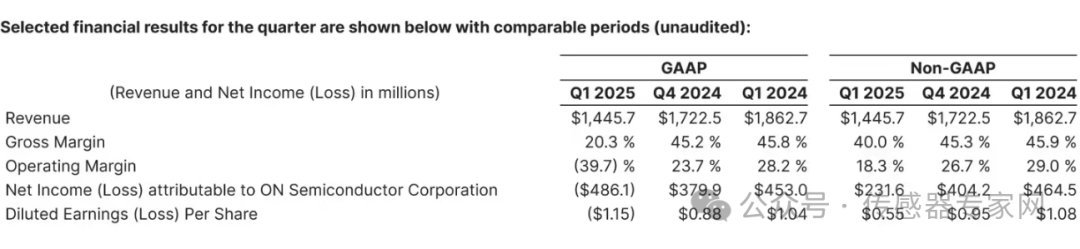

安森美2025年第一季度收入14.457億美元:同比下滑22%、環(huán)比下滑16%

安森美2025年第一季度業(yè)績(jī) 收入14.457億美元 自由現(xiàn)金流持續(xù)增長(zhǎng)

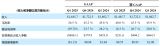

安森美2024年Q4及全年業(yè)績(jī)亮眼

AMD公布2024年第四季度及年度財(cái)報(bào)

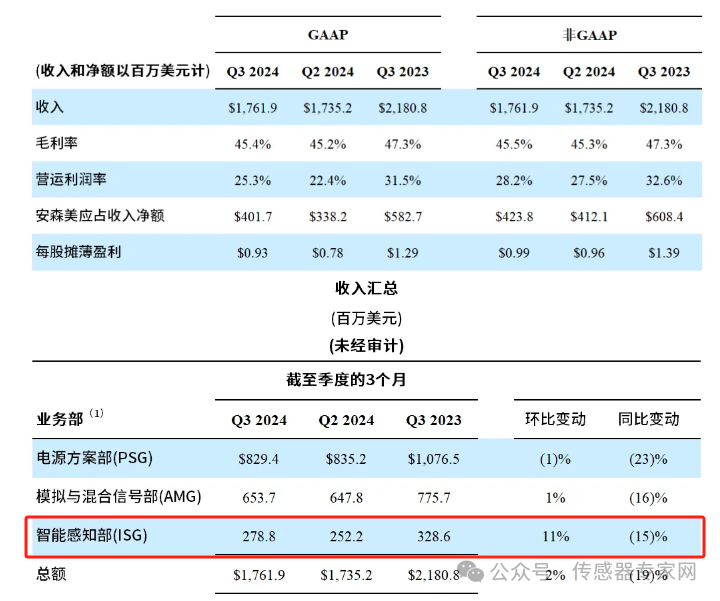

安森美第三季度營(yíng)收超預(yù)期,傳感器開始挑起重?fù)?dān)了

小米公布第三季度業(yè)績(jī)報(bào)告 小米第三季度營(yíng)收925.1億元 小米現(xiàn)金儲(chǔ)備1516億

中芯國(guó)際三季度財(cái)報(bào)亮眼,營(yíng)收毛利雙增長(zhǎng)

AMD公布2024年第三季度財(cái)報(bào)

安森美公布 2024 年第三季度業(yè)績(jī)

芯聯(lián)集成第三季度營(yíng)收增長(zhǎng)超27%,毛利率轉(zhuǎn)正達(dá)6.16%

芯聯(lián)集成發(fā)布前三季度業(yè)績(jī)預(yù)告:營(yíng)收與利潤(rùn)持續(xù)高增長(zhǎng)

鴻海第二季度業(yè)績(jī)飆升,凈利潤(rùn)環(huán)比增長(zhǎng)59%

半導(dǎo)體設(shè)備商KLA發(fā)布2024年第二季度財(cái)報(bào) 總收入25.7億美元

英飛凌2024財(cái)年第三季度營(yíng)收和利潤(rùn)略有增長(zhǎng)

安森美公布第4季度及2021財(cái)年業(yè)績(jī)實(shí)現(xiàn)了創(chuàng)紀(jì)錄的年度和季度收入、毛利率、利潤(rùn)和現(xiàn)金流

安森美公布第4季度及2021財(cái)年業(yè)績(jī)實(shí)現(xiàn)了創(chuàng)紀(jì)錄的年度和季度收入、毛利率、利潤(rùn)和現(xiàn)金流

評(píng)論